Make sure you are happy with any documents sent by your solicitor.Confirm any Stamp Duty Land Tax/Lands and Buildings Transaction Tax (Scotland only) fees included in the sale.Ask your conveyancer to explain any terms, clauses or details you don’t understand.Get an estimate of costs, including legal fees and tax.any clauses in the property contract that you need to be aware of, such as planning permission.įor customers in Scotland, your solicitor will put in your offer too, and handle negotiations on your behalf.what’s included in the sale aside from the property, including outhouses, sheds, garden and driveway space.who the legal owner is of the property you want to buy.The legal side of a property sale can be handled by a solicitor or licensed conveyancer. If we’re satisfied with your application, we’ll then write to you with a mortgage offer. Sellers in Scotland must provide a Home Report, which includes a survey, Energy Performance Certificate and Property Questionnaire. talk to you about your insurance needs, such such as home insurance and Life Cover.explain the terms and total cost of the mortgage.

complete background checks with a credit reference agency.recommend the most suitable mortgage for you based on your needs and commitments.look at your income and spending commitments.Details of any existing home, life or critical illness insurance policies you have.Īt the appointment, the mortgage adviser will:.Information about the property you want to buy.Relevant documents, such as proof of identity, bank statements, payslips, and details of any financial commitments.What you’ll need to bring to the appointment

(Monday to Friday 8am to 8pm, Saturday 9am to 4pm). You can speak to us over the phone or by video call on 03.

If you’re applying for a mortgage with another person, it’s helpful if they’re at the appointment as well. Appointments with an adviser will take about 2 hours. You can speak to one of our mortgage advisers by phone, video call or in person.

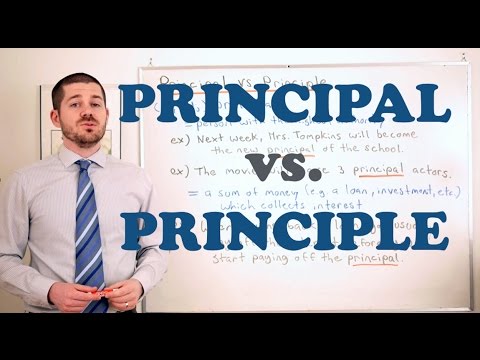

PRINCIPAL VS PRINCIPLE MORTGAGE FULL

You can continue your full mortgage application online. We’ll guide you through the rest of the process, but if you need help, you can speak to one of our expert mortgage advisers by phone or through our mortgage video service.

0 kommentar(er)

0 kommentar(er)